No credible economist would ever want to stick it to the rich, only folks who envy them do. A consumption tax would just enable us to tax them more evenly. You often whine about folks like Buffet only baying 13% cap gains, but say taxing them at 23% of their spending is somehow giving them a bigger break."if you really want to stick it to the rich, do a consumption tax" said no credible economist ever.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A tax analogy, who's really paying their fair share?

- Thread starter beenthere

- Start date

No, they pay almost all of the federal taxes. That's indisputable. The top 10% pay 70%+ of the federal income taxes. This is even with a high level of evasion, of course.

You're saying the same thing I am. I worded my sentence poorly, apologies. Folks bitch about the super wealthy only paying capital gains. That is a much lower percentage than income tax. They also hire accountants and attorneys to help them shelter, hide and deduct much more than they could have otherwise.

Of course high-income earners pay the lions share, poor people dont have much income to tax. Im just saying though, that the poor pay the percentage that is dictated by legislation. The rich and wealthy pay significantly lower because they can. The top bracket is 39%, a person earning 10 million each year, I would be willing to bet, does not pay 39% on the income he earns over the 39% threshold. So they avoid paying it.

Avoidance would not be an issue with the FairTax. Unless of course you see buying a used car a form of tax evasion.

My main point is that I think you're contradicting yourself. You're telling us rich people who want to make more money are going to be put off by a 30% tax rate and not make investments they would have made with a 15% tax rate. At the same time, you're telling us that imposing a new 25% sales tax on everything at the retail point of purchase won't discourage rich people from buying things. This seems very peculiar to me. I am a rich person and I choose to forgo potentially making $100 million because I don't want to pay $30 million in tax, but I seem to have no problem paying an extra $25 million for my $100 million plane. In the first case I would be up $70 million but refuse to do it; in the second case I would be down $125 million in cash but have no problem with it.

Right now capital gains tax rates are historically low. I think they could stand to go up a little. However, Bush dropped them from 20 to 16 and revenue from the rate went up. Dont believe me, there is a very nice chart here that will show that when Bush dropped the rates durring his first term, the revenue generated from this tax DRAMATICALLY increased. Link.

Now, if your goal is to keep folks from getting rich, then raising the rates is the best policy. If your goal is to generate as much revenue as possible, in this case, it appears less is more.

As to spending. It is hard to answer a question based on a false premise (see the bold above.) The actual sticker price on objects probably wont go up much (they might at first, but competition will drive price down.) Take a loaf of bread. Right now when you buy bread you are paying a portion of the taxes of the farmer, the truck driver, the baker, and the store owner (the list could keep going, but I think I made the point). The FairTax eliminates the taxes all of these folks are paying. So after implementation of the FairTax, the amount of money they need to charge to be profitable goes down. As long as they have a competitor, they will lower their prices, probably to a point that gets them around where profit margins are today.

So, the price isn't really going to go up.

Besides, even if it did, people buy things they want and things they need. If they need it, they will buy it. If they want it, they will save for it and get it when they can.

The Joint Committee on Taxation, a nonpartisan body dominated by professional staff, estimated the national sales tax would have to be 36% to be revenue neutral. Add in state sales taxes and the rate approaches 50% in some states. I think this sky high rate would discourage the purchase of new goods, encouraging the purchase of the tax-advantaged goods you've mentioned multiple times. This means less revenue for the federal government and a hit to the economy, which is centered on the production and sale of new goods.

If the used car market explodes, for example, because people don't want to pay a 50% tax on a new car, what kind of impact does that have on the auto industry, which employs hundreds of thousands of people and has hundreds of billions of dollars in economic impact every year?

Ok, my first point here is this. There is a way of calculating the FairTax that would make it a 32% tax, pretty darn close to your JCT estimate. There is a reason why folks say its 23% and it makes sense. It really doesnt matter to me which number is used, because it doesn't change anything.

As to the rest of it. Business and everything right now is structured around or current tax system. Clearly, some industries would suffer. For instance, H&R Block employees would need to find new work. I think a big benefit of the FairTax is business owners could make decisions based on what would be good for business instead of thinking about taxes all the time.

The value of ALL used goods would increase a little. Seems to me this is of benefit to everyone.

The value of used cars would go up. But not tremendously. For instance, they could never exceed the value of a new one. The economics of this would work itself out. Having sold cars I can tell you that there are two kinds of car buyers out there; new car buyers and used car buyers. I can say that in over a year of selling cars on a lot with both that I never showed a used car to a customer who had also looked at a new one. And as explained above, the actual cost of the new car isn't going to be affected as much as you think, if at all, there will still be plenty of new car buyers out there. lol, the auto industry will survive this. Hell they will probably thrive in this.

I think the biggest change in the auto industry might be that those manufacturing jobs that have been sent to Mexico and other places might start coming back to the United States because it will suddenly become much cheaper to do business here.

As to the 23/32%, this rate has been independently confirmed by several different, nonpartisan institutions across the country. Detailed calculations are available from FairTax.org.

Attachments

This is absolutely false. I'm going to found a company and sell it for $100 million. Let's pretend the tax rate is 15% in one world and 30% in another. Now let's imagine I'm in the 30% world. Do I want to found a company and sell it for $100 million if I have to pay $30 million in tax? Nope, I won't. I'll just do nothing.

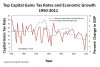

That's totally unrealistic. The empirical evidence informs us that it is totally realistic. See here as just one example: http://taxvox.taxpolicycenter.org/2...-capital-gains-tax-rates-and-economic-growth/. No relationship.

What evidence do you have for your proposition?

Taxation of investments is bracketed just as the taxation of income is, so those middle class folks would be unaffected.

At least we can agree on this.

More mythology. A study by the Federal Reserve Bank of Cleveland concluded that only 8% of Americans get an inheritance of any kind. 92% get nothing. Most who inherit get less than $25,000; 2% of those inheriting receive $100,000+. The average inheritance is skewed by the passage of big wealth to look much, much larger than it actually is.

What burden on the middle class? Most of the 92% of Americans who inherit nothing are middle class or worse and they face no burden whatsoever.

According to who?

I provided a link to that in the post above, Capital gains has a little to do with GDP, but you post them together, and I even included another similar chart in my above post, but you post them together like that is the end all be all of the converstation.

Look at the chart in the link I provided above.

http://taxfoundation.org/article/federal-capital-gains-tax-collections-1954-2009

There it is again.

No correlations to be made, just straight raw unadulterated numbers.

WHEN YOU LOWER THE % OF THE CAPITAL GAINS TAX, THAT TAX GENERATES MORE REVENUE TO THE FEDERAL GOVERNMENT.

That can only mean one thing, a hell of a lot more economic activity is taking place when the tax is lower than when it is higher. Fuck your charts, they are worthless. Look at the real numbers instead of charts made by people wanting to mislead you.

To your comments on the death tax.

So since only a small percentage of the people can expect to benefit from it, we should just take it all? The tyranny of the majority.

I don't know where you get these numbers. I know all kinds of people who got land, chattels, or money from someone who died. I cant cite to a study from Cleveland, but I can remember my Wills Trusts and Estate class where my professor said he knew plenty of lawyers who made a damn good living going out an hustling the will market. I mean by that they spend a lot of time writing wills for people, even small simple wills, for just 100 or 200 dollars.

Those numbers do not mesh with my experience on this planet in any way. I know too many people who have gotten shit from dead relatives. Usually its just straight down.

A will will state, leave shit to wife, if she is dead to kids, if they are dead to grandkids, if there are none sibling, yada yada yada.

I wouldnt be surprised if that study just surveyed inner city Cleveland folks or something.

The fact that libertarians are the ones pushing it is the biggest clue for me. If this idea were so great--revenue neutral, awesome for the economy, perfect in every possible way--then a lot of other people in the mainstream would be behind it. They aren't because the claims come up short. You can't just whisper "Entrenched interests!" If the math looked so perfect and the assumptions were all very credible, there couldn't be much reasonable criticism or such a disparity in the calculation of tax rates.

I think the national sales tax is really just a scheme to deprive the federal government of money, starving it and forcing it to play less of a role in American life. The best way to make government smaller is to take its money away, and then at that point, when they ask for more money, people will say, "What? No! I'm paying a 25% national sales tax!" It's very convenient for their agenda.

That might be true, but they solicited a wide rage of experts who all came to the same conclusion.

A lot of people, and I fear you are among them, cannot do what is necessary to grasp the FairTax. It isnt just adding a new tax. It is taking away all the others, it is putting new ones in, it is passing an amendment to the constitution, and it is changing something that has become very ingrained in our society.

So much is shaped by the income tax. Terms like "take home" pay.

The fact that you would seemingly fail to consider an idea because of who came up with it might just tell one all they need to know about you. Fairly closed minded. I am opinionated, but I, at least think I am open minded.

Read up on the history of the FairTax if you want answers to this. They sent out information to several groups that WERE NOT libertarians. The non libertarians sent them back the fairtax.

The criteria were (going from memory) revenue neutrality, progressive, transparent to name a few. They didnt come up with the idea, they solicited the idea.

So what? It's a graph. Is the graph meaningless because it came from Brookings? Absolutely not.

If you can tell me what's flawed about the graph and produce evidence that contradicts my conclusion, I would love to see that.

I told you what was wrong with it. Its the cap gains tax and GDP graph?

There are too many factors in GDP to narowly limit it to capital gains.

If you want proof its a bullshit graph, Ill give you the link for a third time - http://taxfoundation.org/article/federal-capital-gains-tax-collections-1954-2009

UncleBuck

Well-Known Member

No credible economist would ever want to stick it to the rich, only folks who envy them do. A consumption tax would just enable us to tax them more evenly. You often whine about folks like Buffet only baying 13% cap gains, but say taxing them at 23% of their spending is somehow giving them a bigger break.

you only tax 23% of a very small percentage of what he makes with a consumption tax though, so it works out to be 23% of 1% or 2% of his income. that means he is now taxed at half a percent or so, instead of 13%.

of course, you are mathematically retarded and ignored the immutable laws of mathematics that i pointed out earlier. hence why you work at subway.

UncleBuck

Well-Known Member

Damn, you sure told me.

Which one happened on this topic? I posted links of both conservative and liberal economists advocating a consumption tax or you posting links of any conservative economists against it?

You really aren't very good at this honesty thing but you sure are good at insults and talking out of your ass. I guess that's why you stick with it, go with what you know, because it sure isn't economics.

Tell us more about aggregate demand daddy?

"I'm operating more on theory"

lullerskates.

UncleBuck

Well-Known Member

LOL Then you clearly have no frikin clue what you are doing.

how is it a strawman?

i made no misrepresentation of ginwilly's position, in fact i quoted him pretty much 100% accurately. he once said that a consumption tax would stick it to the rich.

perhaps you can not believe someone could be that dumb, hence you thought i was misrepresenting his position. but he was being that dumb.

i added a sarcastic "said no credible economist ever" after, to mock him.

it's kind of like saying "not" after something.

here is a tutorial for someone who is marginally retarded like you:

[video=youtube;w4k5NwDcucc]http://www.youtube.com/watch?v=w4k5NwDcucc[/video]

you only tax 23% of a very small percentage of what he makes with a consumption tax though, so it works out to be 23% of 1% or 2% of his income. that means he is now taxed at half a percent or so, instead of 13%.

of course, you are mathematically retarded and ignored the immutable laws of mathematics that i pointed out earlier. hence why you work at subway.

You have no idea what the guy spends. I don't either.

Be hones for one second and answer one honest question honestly.

Should the purpose of taxes be;

A) Generation of revenue

B) A social-engineering tool

C) A combination of A and B

D) Other (Explain)

UncleBuck

Well-Known Member

You have no idea what the guy spends. I don't either.

Be hones for one second and answer one honest question honestly.

Should the purpose of taxes be;

A) Generation of revenue

B) A social-engineering tool

C) A combination of A and B

D) Other (Explain)

i don't need to answer that question, since it has nothing to do with the unassailable fact that the "fair" tax is regressive and idiotic.

i don't need to answer that question, since it has nothing to do with the unassailable fact that the "fair" tax is regressive and idiotic.

Unassailable, how awesomely impressive?

I swear, you are the queen of the thesaurus, aren't you.

UncleBuck

Well-Known Member

Unassailable, how awesomely impressive?

I swear, you are the queen of the thesaurus, aren't you.

better than being the queen of haight street, like you.

better than being the queen of haight street, like you.

Didn't make a bit of frikin sense.

LOL I can tell you're a tourist.

heckler73

Well-Known Member

No credible economist would ever want to stick it to the rich, only folks who envy them do. A consumption tax would just enable us to tax them more evenly. You often whine about folks like Buffet only baying 13% cap gains, but say taxing them at 23% of their spending is somehow giving them a bigger break.

I would not consider Kotlikoff as being a "credible economist" simply because he believes in the "gov't as household" fallacy. But that aside, do you understand how that 23% was calculated? Are you aware of the questionable assumptions required to make it work?

Here's the paper I'm looking at so you can check it out for yourself:

http://www.fairtax.org/PDF/Tax Notes article on FT rate.pdf

And here's Gale's critique (which I would suggest looking at first since it was written prior to the above):

http://www.urban.org/UploadedPDF/1000785_Tax_Break_5-16-05.pdf

My immediate takeaway from the two papers is there would be an increase in used sales (excluded) and a fall in production of new goods (thanks to the tax), especially in autos. That doesn't leave a hell of a lot of room for the already crippled manufacturing sector.

Furthermore, this concept increases the burden on those at the median since rents are now included in the tax scheme, never mind all of their regular spending (food, clothes, utilities). Let's not forget the issues of "sticky wages and prices". That creates a dilemma immediately at the producer's end.

There are some interesting effects on the financial sector, though. Almost everything associated with equity markets would be taxed. But considering the backlash over a measly Tobin tax, I highly doubt they would let this go through without great uproar.

One of the loopholes that stands out, as I think about it, is the exclusion of "business to business" sales. Those at the median and below are unlikely to be business owners. Meanwhile, those in the upper quintiles do have the capacity to create companies (even if they don't really exist). This allows the "rich" to escape the consumption tax by footing the bill to their "companies". And since there is no more IRS under this scheme, who's going to investigate?

Overall, the promises of this scheme are dubious, and literally is shifting the tax burden on those at the median (and surrounding quintiles). If your goal is to empower the middle income earners, this is a terrible way to do it. As for the poor, nothing seems to change (assuming the demogrants actually cover the discrepancies).

I don't understand the "intricacies" perhaps as well as you do, so maybe you can straighten out these wrinkles I'm perceiving? But looking at the two presentations, I'm currently on side with the "apples-to-apples" comparison of Gale's over the "fixed assumptions" of the former.

UncleBuck

Well-Known Member

What the fuck does that have to do with Haight St.

what does stinking like AIDS have to do with haight street?

oh, nothing.

pro tip: don't read a history book, or else you will have to BITCH SLAP LMFAO yourself.

nontheist

Well-Known Member

I would not consider Kotlikoff as being a "credible economist".

I didn't know there was such a thing, unless a monkey with a dart board is credible science to you. Economist are valuable for advice on fiscal policy. They're useless at predicting the future.

Of course it does. I have a suspicion that you think taxes ought to be used to take money to spite the rich and redistribute it to the poor.i don't need to answer that question, since it has nothing to do with the unassailable fact that the "fair" tax is regressive and idiotic.

To hell with the fact that the FairTax is good for the poor and middle class, it is also good for the rich.

That attitude wont get you anywhere son, except the welfare line.

UncleBuck

Well-Known Member

Of course it does. I have a suspicion that you think taxes ought to be used to take money to spite the rich and redistribute it to the poor.

To hell with the fact that the FairTax is good for the poor and middle class, it is also good for the rich.

That attitude wont get you anywhere son, except the welfare line.

if i wanted horrible advice from a subway sandwich maker, i would walk down the block to subway.

I would not consider Kotlikoff as being a "credible economist" simply because he believes in the "gov't as household" fallacy. But that aside, do you understand how that 23% was calculated? Are you aware of the questionable assumptions required to make it work?

Here's the paper I'm looking at so you can check it out for yourself:

http://www.fairtax.org/PDF/Tax Notes article on FT rate.pdf

And here's Gale's critique (which I would suggest looking at first since it was written prior to the above):

http://www.urban.org/UploadedPDF/1000785_Tax_Break_5-16-05.pdf

My immediate takeaway from the two papers is there would be an increase in used sales (excluded) and a fall in production of new goods (thanks to the tax), especially in autos. That doesn't leave a hell of a lot of room for the already crippled manufacturing sector.

Furthermore, this concept increases the burden on those at the median since rents are now included in the tax scheme, never mind all of their regular spending (food, clothes, utilities). Let's not forget the issues of "sticky wages and prices". That creates a dilemma immediately at the producer's end.

There are some interesting effects on the financial sector, though. Almost everything associated with equity markets would be taxed. But considering the backlash over a measly Tobin tax, I highly doubt they would let this go through without great uproar.

One of the loopholes that stands out, as I think about it, is the exclusion of "business to business" sales. Those at the median and below are unlikely to be business owners. Meanwhile, those in the upper quintiles do have the capacity to create companies (even if they don't really exist). This allows the "rich" to escape the consumption tax by footing the bill to their "companies". And since there is no more IRS under this scheme, who's going to investigate?

Overall, the promises of this scheme are dubious, and literally is shifting the tax burden on those at the median (and surrounding quintiles). If your goal is to empower the middle income earners, this is a terrible way to do it. As for the poor, nothing seems to change (assuming the demogrants actually cover the discrepancies).

I don't understand the "intricacies" perhaps as well as you do, so maybe you can straighten out these wrinkles I'm perceiving? But looking at the two presentations, I'm currently on side with the "apples-to-apples" comparison of Gale's over the "fixed assumptions" of the former.

Very good questions, I don't have all the answers as these are by far the most advanced questions I have been asked. I quit following this plan closely (or at all) a few years ago, but at one time I would have called myself an expert.

As to how they came up with 23%. I think it will work. If not, at least now congress cannot punish specific groups, regions or activities. IF WE NEED TO RAISE TAXES WE ALL PAY MORE TAXES. So when taxes are raised, it effects everyone. Thats a good thing.

I do not think that the production of new autos would be impacted at all. Used items can only rise in value up to a certian point below what the new counterpart cost. Since so much of the make up in what an item costs is the taxes paid by the company to produce it, the price of new cars would probably go down, if anything. But I don't have a crystal ball.

I think a better way to say it is that more used goods would retain value. But I think 1999 Nissan Altima in decent shape would still be a $2500 dollar car. And a new one would still be $25,000. I simply think it would be easier to sell used goods... other than cars.

Used cars are currently quite a bit cheaper than new ones, yet plenty of people still opt to buy the new, because they want the new and they can afford it. Same would work here.

You had one very perceptive response, the least benefit comes to those in the $80-$120k crowd. Though the percentages are negligible. I mean seriously, its less than 5% in any scenario I've seen. But consider, the "tax burden" isn't really felt like it is now. This isn't money taken out of your check, it is money included in the cost of goods and services you buy. So being smart and frugal can reduce your tax. Also, since I think I have shown fairly well that prices will not be 23% higher than they are now, even though they arent as benefited, you really cant say they are hurt. Their purchasing power would still go up. They would have ALL of their checks to spend how they wished, on goods that probably cost the same or less than they do now. And they still get the prebate.

Basically I see it like this. Although the percentage of revenue generated from the median quartiles goes up, they arent affected as much as one would think that statement implies. This all hinges, of course, on competition driving prices down after the implementation of a 23% tax. I think that is almost as sure as night follows day. But I could see how a select few services and goods could not have a reduction in price. Namely, it would have to be one without much, if any competition. So although the percentage of revenue coming from these quartiles goes up, so does the purchasing power. I guess the way to say it is they aren't benefited as much as others, but they still have a benefit. If Im lucky, Ill be in this quartile this year. I still would want the FairTax.

Can you think of a product/service that doesnt have competition? I cant.

Anyway, there are some weird things about this, that is for sure.

I am well aware it isn't perfect. The elderly, for instance, have saved their whole life. The money they saved was taxed, now they buy things with that money, and its taxed.

But what I think this does is increase the purchasing power of everyone.

Is the FairTax perfect? Nope.

But I get rather frustrated at people when it is discussed. They find a flaw or two and then they are done with it. We can sit and find flaws all day long with our current tax system.

Our current tax system was designed in the later part if the 19th century. We dont use much that was designed back then anymore. Yet folks like Buck cling to it, all the while screaming how terrible it is because the rich keep screwing everyone by avoiding taxes.

Let not the dream of a perfect plan impede the progress of a good one. - me lol, but Im sure someone else has said it somewhere.

Knowing what you know about the FairTax and our current taxes, if we were starting a new country tomorrow, which would you impliment?

The fairtax is a 21st century tax, the income tax is a 19th century tax. England abolished an income tax a couple hundred years ago and had a economic boon lasting over a century. It only ended when they implemented the income tax again.

Similar threads

- Replies

- 4

- Views

- 301

- Replies

- 0

- Views

- 435

- Replies

- 19

- Views

- 903

- Replies

- 39

- Views

- 5K