budsmoker87

New Member

http://www.inflation.us/federalreserveqe3.html

The Federal Reserve Must Implement QE3

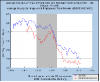

Gold prices surged today to a new all time high of $1,463.70 per ounce, while silver prices soared to a new 31-year high of $39.785 per ounce. Silver is now up 129% since NIA declared silver the best investment for the next decade on December 11th, 2009, at $17.40 per ounce. The gold/silver ratio is now down to 37, compared to a gold/silver ratio of 66 when NIA declared silver the best investment for the next decade. This means that not only is silver up 129% in terms of dollars since December 11th, 2009, but silver has also increased in purchasing power by 1.78X in terms of gold.

Gold is the world's most stable asset and the best gauge of inflation. This brand new breakout in the price of gold leads us to believe that the Federal Reserve is getting ready to unleash QE3 at the end of June. The Fed will surely not call it QE3, but NIA can pretty much guarantee that the Fed will continue on with their purchases of U.S. treasuries. If the Fed pauses after QE2, it will mean that treasury bond yields will need to surge to a level where they attract enough private sector and foreign central bank buyers in order to not only support the funding of our rapidly rising budget deficits, but to support the redemption of maturing treasury securities.

In the month of March, the U.S. government spent more than eight times its monthly tax receipts, when you include the money spent for maturing U.S. treasuries. The U.S. treasury netted $128.18 billion in tax receipts during the month of March, but paid out a total of $1.05 trillion, which included $49.8 billion in Social Security benefits, $47.4 billion in Medicare benefits, $22.58 billion in Medicaid benefits, and $37.9 billion in defense spending. However, by far, the U.S. paid out the most for maturing U.S. treasuries, which equaled $705.3 billion.

In order for the U.S. government to stay afloat with only $128.18 billion in tax receipts, it had to spend $72.5 billion from its balance of cash, which ended the month at $118.1 billion, and sell $18 billion worth of TARP assets. But most importantly, the U.S. treasury had to sell $786.5 billion in new treasury bonds.

The U.S. government is the largest ponzi scheme in world history. We can only fund our government expenditures and pay off maturing debt plus interest, by issuing larger amounts of new debt. Americans are lucky that we have been blessed with record low interest rates for an unprecedented amount of time, but NIA believes that as we roll over U.S. treasuries in the future, we will have to refinance them at much higher interest rates. Our national debt is now so large that interest payments on our debt will become the government's largest monthly expenditure.

If the Federal Reserve doesn't implement QE3, NIA believes it will just about guarantee a bursting of the U.S. bond bubble in the second half of 2011. If the Fed stops buying U.S. treasuries, there is a chance that we won't find foreign buyers for our bonds no matter how high interest rates rise. The world is waking up to the fact that the U.S. government is insolvent, and the benefits of propping up the U.S. dollar are no longer worth the expense to our foreign creditors. The U.S. government ponzi scheme will soon be exposed for the world to see.

Japan has been the most consistent buyer of U.S. treasuries. With Japan needing to raise $300 billion to rebuild parts of their country that were destroyed by the earthquake, tsunami, and nuclear disaster, we believe they will be forced to dump their U.S. treasuries, at a time when the U.S. desperately needs Japan to roll over their treasuries into larger amounts of new ones. Not only that, but with Arab revolutions taking place across major Saudi states and the U.S. beginning to occupy Libya for no reason at all, we will likely see Gulf states follow in Japan's footsteps and stop purchasing/dump U.S. treasuries. Plus, China appears to be becoming more reluctant to continue buying U.S. treasuries, and is positioning the yuan to be the world's new reserve currency. Without Japan, Saudi states, and China, there will be no buyers left for U.S. government bonds.

The fact is, with no QE3, we could literally see the 10-year bond yield double from 3.52% to north of 7%, overnight. Even then, it is unlikely to attract foreign buyers and we will likely be faced with failing bond auctions, which would cause a massive rush out of the U.S. dollar and trigger the currency crisis NIA has been predicting. NIA sees no other option for the Fed, but for it to continue on with its endless money printing and destructive inflationary policies.

Federal Reserve officials discussed last month in closed-door meetings the possibility that rising commodity prices could cause inflation. The fact is, rising commodity prices don't cause inflation, they are a symptom of inflation. When the Fed leaves interest rates at 0% for over two years and prints $600 billion as part of QE2, that money printing and easy money is the inflation of our money supply, and rising prices are the result.

The Fed is narrow-minded and continues to focus on the CPI, which only grew last month by 2.11% year-over-year. Fed Chairman Ben Bernanke says he expects rising commodity prices to create a transitory boost in U.S. inflation. Meaning, when the CPI rises even higher in the upcoming months, Bernanke will likely place the blame on what he considers to be temporarily high oil and soft commodity prices.

The CEO of Wal-Mart is now saying that U.S. inflation is going to be very serious and that Wal-Mart is already seeing cost increases starting to come through at a pretty rapid rate. He predicts that because of huge increases in raw material costs, along with soaring labor costs in China, and skyrocketing fuel costs around the world, retail prices will start increasing at Wal-Mart and all of their competitors in June, especially for clothing and food.

When asked about the predictions of Wal-Mart's CEO, Bernanke said that he expects price pressures to remain largely stable, but then added, "Wal-Mart has more data than the government does." Bernanke was also quoted as saying, "We have to monitor inflation and inflation expectations extremely closely because if my assumptions prove not to be correct, then we would certainly have to respond to that and ensure that we maintain price stability.

The European Central Bank (ECB) is expected to raise interest rates tomorrow for the first time since 2008. Many people are now speculating that the Federal Reserve will begin raising the Federal Funds Rate at the end of 2011. NIA is receiving many new 'NIAnswers' and email questions on a daily basis, asking us what will happen to gold and silver prices if the Federal Reserve were to raise interest rates.

In our opinion, the Federal Reserve raising the Fed Funds Rate would actually be very bullish for gold and silver prices, because it will serve as an admission that even the Fed believes inflation is becoming a major problem and beginning to spiral out of control. Historically, the best performing time period for precious metals has been when the Fed begins to raise artificially low rates. Remember, when the Fed begins to raise rates, they will probably raise rates only 1/4 or possibly 1/2 of a percentage point at a time. Interest rates of 1% or 2%, although higher than 0%, are still artificially low and will do nothing to curtail inflation. NIA believes the real rate of U.S. price inflation is now 6% and we will need to see the Fed Funds Rate rise to a level that is higher than the real rate of price inflation, if the Fed wants to have any hope of preventing hyperinflation.

The Federal Reserve Must Implement QE3

Gold prices surged today to a new all time high of $1,463.70 per ounce, while silver prices soared to a new 31-year high of $39.785 per ounce. Silver is now up 129% since NIA declared silver the best investment for the next decade on December 11th, 2009, at $17.40 per ounce. The gold/silver ratio is now down to 37, compared to a gold/silver ratio of 66 when NIA declared silver the best investment for the next decade. This means that not only is silver up 129% in terms of dollars since December 11th, 2009, but silver has also increased in purchasing power by 1.78X in terms of gold.

Gold is the world's most stable asset and the best gauge of inflation. This brand new breakout in the price of gold leads us to believe that the Federal Reserve is getting ready to unleash QE3 at the end of June. The Fed will surely not call it QE3, but NIA can pretty much guarantee that the Fed will continue on with their purchases of U.S. treasuries. If the Fed pauses after QE2, it will mean that treasury bond yields will need to surge to a level where they attract enough private sector and foreign central bank buyers in order to not only support the funding of our rapidly rising budget deficits, but to support the redemption of maturing treasury securities.

In the month of March, the U.S. government spent more than eight times its monthly tax receipts, when you include the money spent for maturing U.S. treasuries. The U.S. treasury netted $128.18 billion in tax receipts during the month of March, but paid out a total of $1.05 trillion, which included $49.8 billion in Social Security benefits, $47.4 billion in Medicare benefits, $22.58 billion in Medicaid benefits, and $37.9 billion in defense spending. However, by far, the U.S. paid out the most for maturing U.S. treasuries, which equaled $705.3 billion.

In order for the U.S. government to stay afloat with only $128.18 billion in tax receipts, it had to spend $72.5 billion from its balance of cash, which ended the month at $118.1 billion, and sell $18 billion worth of TARP assets. But most importantly, the U.S. treasury had to sell $786.5 billion in new treasury bonds.

The U.S. government is the largest ponzi scheme in world history. We can only fund our government expenditures and pay off maturing debt plus interest, by issuing larger amounts of new debt. Americans are lucky that we have been blessed with record low interest rates for an unprecedented amount of time, but NIA believes that as we roll over U.S. treasuries in the future, we will have to refinance them at much higher interest rates. Our national debt is now so large that interest payments on our debt will become the government's largest monthly expenditure.

If the Federal Reserve doesn't implement QE3, NIA believes it will just about guarantee a bursting of the U.S. bond bubble in the second half of 2011. If the Fed stops buying U.S. treasuries, there is a chance that we won't find foreign buyers for our bonds no matter how high interest rates rise. The world is waking up to the fact that the U.S. government is insolvent, and the benefits of propping up the U.S. dollar are no longer worth the expense to our foreign creditors. The U.S. government ponzi scheme will soon be exposed for the world to see.

Japan has been the most consistent buyer of U.S. treasuries. With Japan needing to raise $300 billion to rebuild parts of their country that were destroyed by the earthquake, tsunami, and nuclear disaster, we believe they will be forced to dump their U.S. treasuries, at a time when the U.S. desperately needs Japan to roll over their treasuries into larger amounts of new ones. Not only that, but with Arab revolutions taking place across major Saudi states and the U.S. beginning to occupy Libya for no reason at all, we will likely see Gulf states follow in Japan's footsteps and stop purchasing/dump U.S. treasuries. Plus, China appears to be becoming more reluctant to continue buying U.S. treasuries, and is positioning the yuan to be the world's new reserve currency. Without Japan, Saudi states, and China, there will be no buyers left for U.S. government bonds.

The fact is, with no QE3, we could literally see the 10-year bond yield double from 3.52% to north of 7%, overnight. Even then, it is unlikely to attract foreign buyers and we will likely be faced with failing bond auctions, which would cause a massive rush out of the U.S. dollar and trigger the currency crisis NIA has been predicting. NIA sees no other option for the Fed, but for it to continue on with its endless money printing and destructive inflationary policies.

Federal Reserve officials discussed last month in closed-door meetings the possibility that rising commodity prices could cause inflation. The fact is, rising commodity prices don't cause inflation, they are a symptom of inflation. When the Fed leaves interest rates at 0% for over two years and prints $600 billion as part of QE2, that money printing and easy money is the inflation of our money supply, and rising prices are the result.

The Fed is narrow-minded and continues to focus on the CPI, which only grew last month by 2.11% year-over-year. Fed Chairman Ben Bernanke says he expects rising commodity prices to create a transitory boost in U.S. inflation. Meaning, when the CPI rises even higher in the upcoming months, Bernanke will likely place the blame on what he considers to be temporarily high oil and soft commodity prices.

The CEO of Wal-Mart is now saying that U.S. inflation is going to be very serious and that Wal-Mart is already seeing cost increases starting to come through at a pretty rapid rate. He predicts that because of huge increases in raw material costs, along with soaring labor costs in China, and skyrocketing fuel costs around the world, retail prices will start increasing at Wal-Mart and all of their competitors in June, especially for clothing and food.

When asked about the predictions of Wal-Mart's CEO, Bernanke said that he expects price pressures to remain largely stable, but then added, "Wal-Mart has more data than the government does." Bernanke was also quoted as saying, "We have to monitor inflation and inflation expectations extremely closely because if my assumptions prove not to be correct, then we would certainly have to respond to that and ensure that we maintain price stability.

The European Central Bank (ECB) is expected to raise interest rates tomorrow for the first time since 2008. Many people are now speculating that the Federal Reserve will begin raising the Federal Funds Rate at the end of 2011. NIA is receiving many new 'NIAnswers' and email questions on a daily basis, asking us what will happen to gold and silver prices if the Federal Reserve were to raise interest rates.

In our opinion, the Federal Reserve raising the Fed Funds Rate would actually be very bullish for gold and silver prices, because it will serve as an admission that even the Fed believes inflation is becoming a major problem and beginning to spiral out of control. Historically, the best performing time period for precious metals has been when the Fed begins to raise artificially low rates. Remember, when the Fed begins to raise rates, they will probably raise rates only 1/4 or possibly 1/2 of a percentage point at a time. Interest rates of 1% or 2%, although higher than 0%, are still artificially low and will do nothing to curtail inflation. NIA believes the real rate of U.S. price inflation is now 6% and we will need to see the Fed Funds Rate rise to a level that is higher than the real rate of price inflation, if the Fed wants to have any hope of preventing hyperinflation.