hanimmal

Well-Known Member

Here is another post from that blog. I think that it is pretty good because it describes some of the pre-conceived notions that are incorrect. Especially about us and manufacturing, is what I found most interesting, and the foreign trade is just a bonus.

Economics: The 180 Degree Science!

Now is that time of year when thousands of high school and college students across the world will be taking their very first economics course. Perhaps it will be a basic, high school introductory economics course, or perhaps an even more challenging AP or IB economics course. Or perhaps you are a freshman or sophomore in college taking an introductory macroeconomics or microeconomics course.

Whatever your situation, you will soon read that all introductory economic text book authors make the point, usually in their respective texts first chapter, that a primary benefit of studying economics is that it aims to transform one into a more effective and influential citizen by enabling one to better understand and conclude on the economic positions and promises of those running for public office.

The underlying logic is that a citizen or voter that is well-versed in basic economic principles will be a smarter citizen and more likely to vote for the political candidate or referendum that will deliver the greatest economic gain for the citizens of the locality, state, and/or nation. In fact, this economics for citizenship reason is why a growing number of states now require completion of a basic economics course as a requirement for high school graduation.

In my classroom, I informally call the study of economics the 180 degree science because as the student studies this social science for the very first time they often develop conclusions that are precisely the opposite (hence, the 180 degrees) of what they had originally believed before taking their first economics course.

For example, here are two 180 degree moments, which are applicable to the United States economy, that you may well learn in your first year economics course:

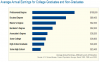

1. Pre-Econ Course or Uninformed View: We dont make anything anymore in America. Americas manufacturing prowess is in a state of constant decline. It seems like almost everything bought and used in the U.S. is made in China

Post-Econ Course and 180 Degree View: Right before the recession hit in 2007, the U.S. was manufacturing approximately 2.5 times more in dollar value than China and is still today the largest manufacturer in the world.

The dollar value of manufactured goods in the United States, restated for price level changes so the comparison is accurate, is up over 50% for the last 13 years ending in June of 2007, just prior to the recession! Yes, it is true that the U.S. has lost several million jobs in manufacturing over that same time period, but that is primarily due to rising manufacturing productivity (think machines & technology replacing humans), where the U.S. can now produce more valuable manufactured products than ever before freeing up those displaced manufacturing workers who now have found or must find employment in other more labor-intensive service-related businesses.

Moreover, the US has maintained its percentage share of rising global manufacturing product over that same aforementioned time period, whereas other countries, such as Japan and Germany, have actually decreased their percentage share of global manufactured product.

More specifically, in 2006 U.S. manufacturing revenue, profits, exports, and productivity per employee reached their all time peak! Of course, with the current recession and the regression of the U.S. automobile industry, manufacturing levels are now below the levels of 2006.

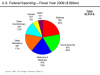

According to government statistics, manufacturing still accounts for slightly over a third of our economic activity and the U.S. will continue to grow in production value, although manufacturing will continue to decline as a percentage of overall economic activity as the United States is growing faster in services than in manufacturing.

2. Pre-Econ Course or Uninformed View: It is patriotic for U.S. citizens to buy American so that we can help our own economy. When we buy foreign products (i.e., exports), in lieu of American products, we hurt our U.S. economy as we lose American jobs and incomes. I hope the recently passed stimulus bill monies will be spent entirely on U.S. products and services.

Post-Econ Course and 180 Degree View: The U.S. will benefit the most economically if Americans buy what they consider to be the very best product, in terms of price and quality, regardless of whether it is a foreign-produced product or an American-produced product. One of the greatest ah-ha moments in all of economics is when an economics student or citizen learns for the first time that every time a U.S. buyer purchases a foreign product (i.e., an import) that those same U.S. dollars spent on the foreign product circle back to a U.S.- based company, not a foreign company.

Yes, I am telling you that when you (or Wal-Mart, for example) buy Chinese shirts, your same U.S. dollars spent quickly end up in the hands of, say, an Apple, Microsoft, IBM, or General Electric to maintain or increase U.S. employment, profits, and stock prices!

Let me try to explain this concept in more detail so that I may actually be able to convince you of this amazing 180 degree revelation. I always say the more accurate slogan should be Buying American is Un-American, since it creates a weaker America!

Lets say that the United States (well say Wal-Mart) decides to buy some shirts costing $400 from a Chinese shirt manufacturer, in lieu of buying similar shirts from, say, a shirt manufacturer in Elon, North Carolina (USA). The first key point is that when Wal-Mart buys the shirts from China for $400 it can only pay China with US dollars. Why? Because Wal-Mart has only US dollars!

It has no Chinese currency (Yuan). It literally drains its bank account of US dollars that are transferred/paid to China! The second key point is that when China receives that same $400 US dollars for the shirts, China cannot, unfortunately, spend any of the $400 in its own economy since only the Yuan is accepted as a medium of exchange in China!

China is now forced to either throw the U.S. currency away (not advised!), or immediately spend the money back to the USA (advised!).

In summary, China has initially traded a product (shirts!) for paper (US dollars!), and those US dollars cannot be spent in China. For China to receive any value at all for the shirts it sent to America, China must now spend the $400 back into the US economy for, say, a few i-Pods from Apple (USA). Cutting through to simplicity, in essence, its almost as if Wal-Mart (USA) just paid Apple (USA) $400 directly! Yes, the economic punch line is that all spending by the domestic nation on foreign products (imports), in turn, are spent immediately back to the domestic nation increasing or maintaining that domestic nations employment, income, and standard of living.

And, yes, lets not forget about that Elon, North Carolina shirt maker that did not get the original $400 from Wal-Mart in our above example! Any good economy promotes competition and I will be excited to see if that North Carolina shirt manufacturer can raise their game (increase productivity and/or quality), and hopefully get the next shirt contract from Wal-Mart! If not, well, that North Carolina firm may just have to close down. But remember the key point is that the $400 spent for the Chinese shirts went to Apple, in lieu of the Elon, North Carolina shirt manufacturer.

If Wal-Mart would have bought American by buying from the Elon shirt manufacturer, even though the Chinese shirts were preferable, Wal-Mart would have prevented the more effective U.S. business (Apple, in this example) from getting your U.S. dollars by giving them to the less efficient Elon manufacturer. In short, you would have contributed to American inefficiency and mediocrity, hurting our country! And that is un-American!

Now, you may be thinking the following if you have a little economics background: But the US has a growing trade deficit with China, so China may not immediately buy those i-Pods from Apple for $400. And, you are correct, but that is also not a problem for either the United States or China. What China is really doing right now is deciding to temporarily save or invest a minority percentage of their US dollars received from U.S. import purchases.

Said another way, China is not buying as many US i-Pods as the US is buying Chinese shirts and, of course, we call that situation the US trade deficit which immediately seems to speak problem. But it is really not as big a problem as most people think! China is still spending their saved US dollars back into the US economy, but in different ways. China is saving and investing some of those US dollars directly into the United States economy by building plants in America, buying US stock to fund American companies expansions, and temporarily saving some of their dollars, for future US purchases, by buying US bonds to help the US government pay for other US government initiatives necessitating borrowing. Eventually, China will sell these US bonds and be forced to use those U.S. dollars to buy those i-Pods or build more plants in America to employ more Americans!

I decided to highlight this particular 180 degree moment because of the fact that the recently passed $800 Billion U.S. stimulus bill has some buy American provisions within it. Based on my intuition, I believe that over 95% of adult Americans believe that these buy American clauses somehow help our economy more so than if the stimulus bill was silent on buy American, thus allowing stimulus money to be spent on foreign-produced products as well. Yes, it is an economic principle that if U.S. citizens buy American driven solely by patriotism (and not because they think the product is superior) the American economy actually becomes weaker as the U.S. dollars spent out of patriotism on that American company are, therefore, unintentionally withheld from another more efficient and deserving American company.

In summary, when citizens of any country in the world buy the product that is best for them based on a combination of quality and price, they will be taking the most patriotic action possible to help their own country they love so much! If a domestic citizen sees the foreign product as a better alternative to the domestic product, buy it! Your money spent will immediately find its way back through the trade loop to another business within your country!

Of course, this is why all economists from around the world know that international trade, and not protectionism, helps a countrys standard of living and promotes efficiency and rising standard of livings!

Well enough for now. I could go on and on with more 180 degree moments relating to areas such as standard of living, unemployment, the minimum wage, gasoline taxes, and many others. But well discuss some of those in class and I will cover others through this blog site. For now, I just really hope you look forward to and work hard in your economic course so that, you too, will become a more informed and influential citizen as you begin to see your nations economy, and our global economy, in a whole new light!

Discussion Questions:

1. Do you believe that politicians will promise and enact policy that seems on the surface to be beneficial to a nation, but are actually harmful to that nation?

2. After reading this blog do you begin to see how the huge declines in manufacturing employment are more driven by leaps in productivity (machines and know-how)? How else could we be producing more manufacturing value each year if employment is decreasing?

3. What would happen to a nations standard of living if the government passed a law requiring its citizens to only buy their own domestic products? Why?

4. Do you personally believe you will make your own countrys standard of living grow the fastest if you buy the best product available, whether an import (foreign) or a domestic product?

About the author: Mr. Latter teaches various business courses at Paul VI Catholic High School in Fairfax, Virginia (USA) including AP Economics, Accounting, Marketing, and Personal Finance. Mr. Latter is a Certified Public Accountant (CPA) and former Chief Financial Officer with 10 years of high school business teaching experience. Prior to his career change to teaching in 2000, Mr. Latter spent 21 years in various auditing, accounting, and financial positions with Price Waterhouse, Sprint, and Teleglobe.

About the author: Mr. Latter teaches various business courses at Paul VI Catholic High School in Fairfax, Virginia (USA) including AP Economics, Accounting, Marketing, and Personal Finance. Mr. Latter is a Certified Public Accountant (CPA) and former Chief Financial Officer with 10 years of high school business teaching experience. Prior to his career change to teaching in 2000, Mr. Latter spent 21 years in various auditing, accounting, and financial positions with Price Waterhouse, Sprint, and Teleglobe.

Economics: The 180 Degree Science!

Now is that time of year when thousands of high school and college students across the world will be taking their very first economics course. Perhaps it will be a basic, high school introductory economics course, or perhaps an even more challenging AP or IB economics course. Or perhaps you are a freshman or sophomore in college taking an introductory macroeconomics or microeconomics course.

Whatever your situation, you will soon read that all introductory economic text book authors make the point, usually in their respective texts first chapter, that a primary benefit of studying economics is that it aims to transform one into a more effective and influential citizen by enabling one to better understand and conclude on the economic positions and promises of those running for public office.

The underlying logic is that a citizen or voter that is well-versed in basic economic principles will be a smarter citizen and more likely to vote for the political candidate or referendum that will deliver the greatest economic gain for the citizens of the locality, state, and/or nation. In fact, this economics for citizenship reason is why a growing number of states now require completion of a basic economics course as a requirement for high school graduation.

In my classroom, I informally call the study of economics the 180 degree science because as the student studies this social science for the very first time they often develop conclusions that are precisely the opposite (hence, the 180 degrees) of what they had originally believed before taking their first economics course.

For example, here are two 180 degree moments, which are applicable to the United States economy, that you may well learn in your first year economics course:

1. Pre-Econ Course or Uninformed View: We dont make anything anymore in America. Americas manufacturing prowess is in a state of constant decline. It seems like almost everything bought and used in the U.S. is made in China

Post-Econ Course and 180 Degree View: Right before the recession hit in 2007, the U.S. was manufacturing approximately 2.5 times more in dollar value than China and is still today the largest manufacturer in the world.

The dollar value of manufactured goods in the United States, restated for price level changes so the comparison is accurate, is up over 50% for the last 13 years ending in June of 2007, just prior to the recession! Yes, it is true that the U.S. has lost several million jobs in manufacturing over that same time period, but that is primarily due to rising manufacturing productivity (think machines & technology replacing humans), where the U.S. can now produce more valuable manufactured products than ever before freeing up those displaced manufacturing workers who now have found or must find employment in other more labor-intensive service-related businesses.

Moreover, the US has maintained its percentage share of rising global manufacturing product over that same aforementioned time period, whereas other countries, such as Japan and Germany, have actually decreased their percentage share of global manufactured product.

More specifically, in 2006 U.S. manufacturing revenue, profits, exports, and productivity per employee reached their all time peak! Of course, with the current recession and the regression of the U.S. automobile industry, manufacturing levels are now below the levels of 2006.

According to government statistics, manufacturing still accounts for slightly over a third of our economic activity and the U.S. will continue to grow in production value, although manufacturing will continue to decline as a percentage of overall economic activity as the United States is growing faster in services than in manufacturing.

2. Pre-Econ Course or Uninformed View: It is patriotic for U.S. citizens to buy American so that we can help our own economy. When we buy foreign products (i.e., exports), in lieu of American products, we hurt our U.S. economy as we lose American jobs and incomes. I hope the recently passed stimulus bill monies will be spent entirely on U.S. products and services.

Post-Econ Course and 180 Degree View: The U.S. will benefit the most economically if Americans buy what they consider to be the very best product, in terms of price and quality, regardless of whether it is a foreign-produced product or an American-produced product. One of the greatest ah-ha moments in all of economics is when an economics student or citizen learns for the first time that every time a U.S. buyer purchases a foreign product (i.e., an import) that those same U.S. dollars spent on the foreign product circle back to a U.S.- based company, not a foreign company.

Yes, I am telling you that when you (or Wal-Mart, for example) buy Chinese shirts, your same U.S. dollars spent quickly end up in the hands of, say, an Apple, Microsoft, IBM, or General Electric to maintain or increase U.S. employment, profits, and stock prices!

Let me try to explain this concept in more detail so that I may actually be able to convince you of this amazing 180 degree revelation. I always say the more accurate slogan should be Buying American is Un-American, since it creates a weaker America!

Lets say that the United States (well say Wal-Mart) decides to buy some shirts costing $400 from a Chinese shirt manufacturer, in lieu of buying similar shirts from, say, a shirt manufacturer in Elon, North Carolina (USA). The first key point is that when Wal-Mart buys the shirts from China for $400 it can only pay China with US dollars. Why? Because Wal-Mart has only US dollars!

It has no Chinese currency (Yuan). It literally drains its bank account of US dollars that are transferred/paid to China! The second key point is that when China receives that same $400 US dollars for the shirts, China cannot, unfortunately, spend any of the $400 in its own economy since only the Yuan is accepted as a medium of exchange in China!

China is now forced to either throw the U.S. currency away (not advised!), or immediately spend the money back to the USA (advised!).

In summary, China has initially traded a product (shirts!) for paper (US dollars!), and those US dollars cannot be spent in China. For China to receive any value at all for the shirts it sent to America, China must now spend the $400 back into the US economy for, say, a few i-Pods from Apple (USA). Cutting through to simplicity, in essence, its almost as if Wal-Mart (USA) just paid Apple (USA) $400 directly! Yes, the economic punch line is that all spending by the domestic nation on foreign products (imports), in turn, are spent immediately back to the domestic nation increasing or maintaining that domestic nations employment, income, and standard of living.

And, yes, lets not forget about that Elon, North Carolina shirt maker that did not get the original $400 from Wal-Mart in our above example! Any good economy promotes competition and I will be excited to see if that North Carolina shirt manufacturer can raise their game (increase productivity and/or quality), and hopefully get the next shirt contract from Wal-Mart! If not, well, that North Carolina firm may just have to close down. But remember the key point is that the $400 spent for the Chinese shirts went to Apple, in lieu of the Elon, North Carolina shirt manufacturer.

If Wal-Mart would have bought American by buying from the Elon shirt manufacturer, even though the Chinese shirts were preferable, Wal-Mart would have prevented the more effective U.S. business (Apple, in this example) from getting your U.S. dollars by giving them to the less efficient Elon manufacturer. In short, you would have contributed to American inefficiency and mediocrity, hurting our country! And that is un-American!

Now, you may be thinking the following if you have a little economics background: But the US has a growing trade deficit with China, so China may not immediately buy those i-Pods from Apple for $400. And, you are correct, but that is also not a problem for either the United States or China. What China is really doing right now is deciding to temporarily save or invest a minority percentage of their US dollars received from U.S. import purchases.

Said another way, China is not buying as many US i-Pods as the US is buying Chinese shirts and, of course, we call that situation the US trade deficit which immediately seems to speak problem. But it is really not as big a problem as most people think! China is still spending their saved US dollars back into the US economy, but in different ways. China is saving and investing some of those US dollars directly into the United States economy by building plants in America, buying US stock to fund American companies expansions, and temporarily saving some of their dollars, for future US purchases, by buying US bonds to help the US government pay for other US government initiatives necessitating borrowing. Eventually, China will sell these US bonds and be forced to use those U.S. dollars to buy those i-Pods or build more plants in America to employ more Americans!

I decided to highlight this particular 180 degree moment because of the fact that the recently passed $800 Billion U.S. stimulus bill has some buy American provisions within it. Based on my intuition, I believe that over 95% of adult Americans believe that these buy American clauses somehow help our economy more so than if the stimulus bill was silent on buy American, thus allowing stimulus money to be spent on foreign-produced products as well. Yes, it is an economic principle that if U.S. citizens buy American driven solely by patriotism (and not because they think the product is superior) the American economy actually becomes weaker as the U.S. dollars spent out of patriotism on that American company are, therefore, unintentionally withheld from another more efficient and deserving American company.

In summary, when citizens of any country in the world buy the product that is best for them based on a combination of quality and price, they will be taking the most patriotic action possible to help their own country they love so much! If a domestic citizen sees the foreign product as a better alternative to the domestic product, buy it! Your money spent will immediately find its way back through the trade loop to another business within your country!

Of course, this is why all economists from around the world know that international trade, and not protectionism, helps a countrys standard of living and promotes efficiency and rising standard of livings!

Well enough for now. I could go on and on with more 180 degree moments relating to areas such as standard of living, unemployment, the minimum wage, gasoline taxes, and many others. But well discuss some of those in class and I will cover others through this blog site. For now, I just really hope you look forward to and work hard in your economic course so that, you too, will become a more informed and influential citizen as you begin to see your nations economy, and our global economy, in a whole new light!

Discussion Questions:

1. Do you believe that politicians will promise and enact policy that seems on the surface to be beneficial to a nation, but are actually harmful to that nation?

2. After reading this blog do you begin to see how the huge declines in manufacturing employment are more driven by leaps in productivity (machines and know-how)? How else could we be producing more manufacturing value each year if employment is decreasing?

3. What would happen to a nations standard of living if the government passed a law requiring its citizens to only buy their own domestic products? Why?

4. Do you personally believe you will make your own countrys standard of living grow the fastest if you buy the best product available, whether an import (foreign) or a domestic product?